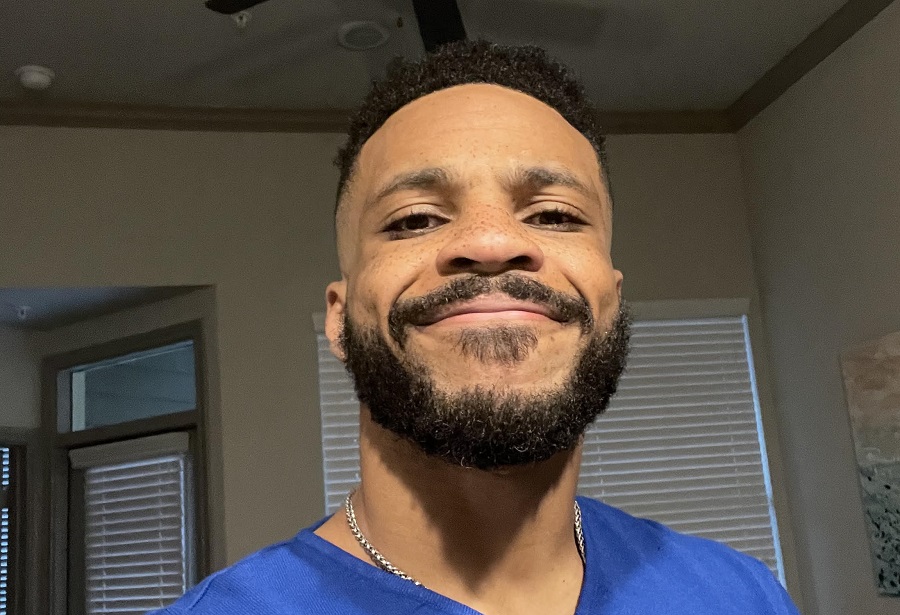

As a fitness entrepreneur, Eugene Pallisco has dedicated his life to equipping people with the knowledge, willpower, confidence, and appropriate technique they need to reach their fitness objectives.

He has devoted a lot of effort to sculpting and refining his training philosophy, which is centered on the improvement of others, ever since working with motivating fitness mentors in high school. Pallisco began his career teaching group fitness classes, then broadened his knowledge by working one-on-one with gym patrons as a personal trainer before starting his private training company in the fitness sector.

Eugene is dedicated to assisting individuals in discovering the joy and freedom in their physical activity, whether through weightlifting, long-distance or high-intensity cardio, or sports training. He is confident that everyone can change their body into a strong, healthy one with the appropriate attitude, patience, and effort.

Entrepreneurship is an evergreen “buzzword.” Why do you think that is?

In my experience, being an entrepreneur can offer several benefits and perks that keep it an enticing proposition, including:

Control and flexibility: As an entrepreneur, you have the freedom to set your own schedule and work on projects that you are passionate about, allowing for a better work-life balance and the ability to pursue other interests.

Opportunity to make a difference: Starting a business can allow you to create something that positively impacts the world and helps solve a problem or meet a need.

Potential for financial success: If your business is successful, you may have the opportunity to earn a higher income than you would in a traditional job.

Independence: Being your own boss can give you a sense of freedom and autonomy that may not be possible in a traditional job.

Being an entrepreneur can be a gratifying and rewarding experience, but it also demands tremendous hard work and attention. I can’t emphasize this last part enough.

Why did you pursue the fitness industry?

Becoming a personal trainer can be a rewarding career choice for people who are passionate about health and fitness and enjoy helping others achieve their fitness goals. Some potential benefits of becoming a personal trainer include:

Personal fulfillment: Helping others improve their health and fitness can be a fulfilling and meaningful career. The reward of helping others, in particular, was my primary motivator in pursuing a career in the fitness industry.

Good pay: Personal trainers can earn a good salary, particularly if they have a solid client base and can charge competitive rates for their services. That said, you should always prioritize the client’s well-being over monetary gains.

Career growth: Personal trainers can advance their careers by earning additional certifications, specializing in certain areas of fitness, or starting their own training businesses, as I’ve done.

It’s important to note that becoming a personal trainer requires a significant commitment of time and energy. In addition to obtaining the necessary certifications, personal trainers must be able to motivate and support their clients and adapt to their clients’ changing needs and goals.

As a fitness professional, I’m sure you don’t back down from a challenge, but I imagine the COVID-19 pandemic took its toll on your industry. How did you overcome this?

The COVID-19 pandemic has significantly impacted the fitness industry. Many gyms and fitness studios were forced to close their doors or substantially limit their capacity to comply with public health measures designed to slow the spread of the virus.

In response, many fitness facilities and trainers, including myself, pivoted to offering virtual classes and training sessions, allowing them to continue serving their clients and generating revenue while in-person classes were impossible. Some facilities also implemented additional health and safety measures, such as frequent cleaning and sanitization, temperature checks, and mandatory masks, to make it safer for clients to return when restrictions were lifted.

In addition, outdoor and socially distanced fitness options, such as outdoor group classes and personal training sessions, became more popular as people sought ways to stay active while minimizing the risk of exposure to the virus. Thankfully, the year-round weather in Dallas is quite pleasant and enabled me to implement this approach.

To continue servicing customers and offering value throughout the epidemic, other fitness professionals and I had to be innovative and adaptive. As vaccination rates rise and public health regulations relax, the sector is expected to change and adapt to suit evolving requirements and concerns.

What are the advantages of working with a personal trainer?

Depending on the client and their goals, the perks will differ, but in most cases, I’ve found that there are several ubiquitous advantages to working with a personal trainer:

Customized workouts: A personal trainer can design a workout plan specifically for your needs and goals, considering your current fitness level, medical history, and any injuries or limitations you may have.

Motivation: Personal trainers can provide encouragement and support to help you stay motivated and committed to your fitness goals.

Expertise: Personal trainers are trained professionals with a wealth of knowledge about exercise, nutrition, and overall health and wellness. They can provide guidance and recommendations to help you achieve your goals safely and effectively.

Safe and effective workouts: Personal trainers can ensure that you are performing exercises correctly and safely, which can help reduce the risk of injury and help you get the most out of your workouts.

Accountability: Having a personal trainer can help you stay accountable for your fitness goals. You are more likely to stick to your workouts and make healthy choices when you have someone to regularly answer to and check in with.

Variety: Personal trainers can help you mix up your workouts and try new activities to keep things exciting and challenging.

Overall, working with a personal trainer can effectively improve your fitness level, help you achieve your goals, and lead a healthier lifestyle. It may not be for everyone, but it’s certainly worth exploring!

How to7 years ago

How to7 years ago

More4 years ago

More4 years ago

More6 years ago

More6 years ago

Interview4 years ago

Interview4 years ago

Other Internet Tech6 years ago

Other Internet Tech6 years ago

More6 years ago

More6 years ago

Business Ideas6 years ago

Business Ideas6 years ago