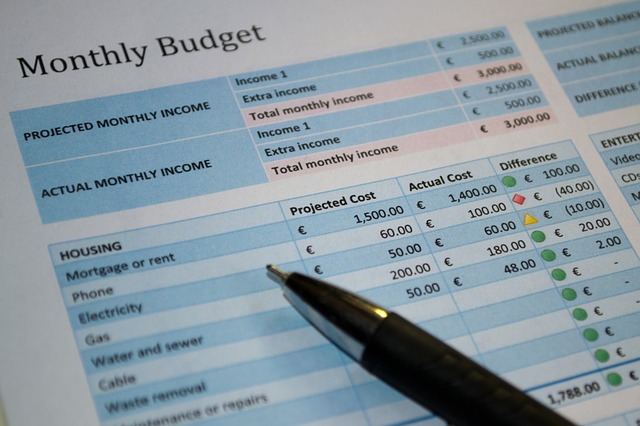

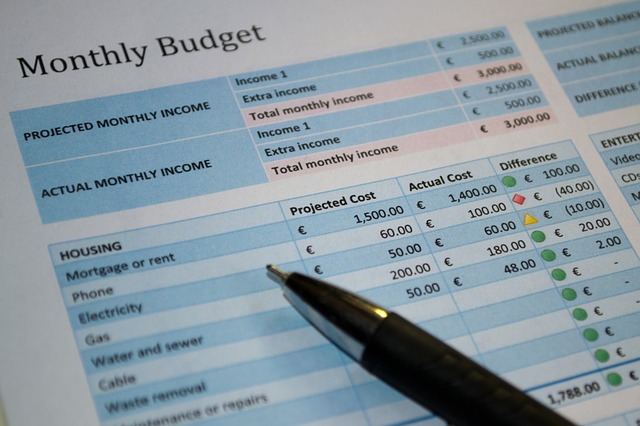

Running short on your monthly budget? Don’t worry, we have you covered.

This article will provide you with 7 of the best quick money options to get you out of your small cash binds. Obviously, when you need money and that too urgently, a small personal loan seems like the best way out. There are no obligations, other than repaying the loan, and also the money is completely legal.

In this article, you’ll find everything, including short-term personal loans and other money-making tricks to satiate your financial needs.

So, stay with us and keep reading to know more.

Online Installment Loans

As already mentioned short-term personal loans are one of the first thoughts to cross many minds when they need urgent money. However, most don’t really know where to look and what to look for in a short-term personal loan.

A rather convenient way to access these unsecured loans is going through an online money lending network. Of course, accessing lending options online reduces the paper-tussle and also speeds up the process.

Typically, taking out an installment loan from a private lender or a bank would require you to visit their corporate office. On the contrary, the online process eliminates all these hurdles.

All you need to do is fill in some basic details, choose the term and amount of the loan, and submit your application. It would usually take not more than 2-3 minutes. Plus, you stand a better chance of receiving an economical loan and that too without having to share your credit history or score.

Payday Loans For Ultra-Short Fund Needs

An alternative to installment loans is a payday loan. While installment loans, as the name suggests, are to be repaid in parts, payday loans are to be repaid one-time.

Notably, these loans are most suitable when you need a very small amount of money. For example, accessing a payday loan for a $500 loan is wise, but when you need more money, it would be better if you look for installment loans.

Although, many lenders offer payday loans up to $5000 or even more, you should only choose these loans when you know you can repay in time and without fail. The biggest issue with payday loans is the processing fee and comparatively high-interest rates against conventional loans.

Liquidating Your Assets

The aforementioned loans are mostly for those who do not have any assets to liquidate or mortgage against. Of course, when you have no savings or investments, you can presume to have no backup. And you’re left with no other option than seeking a short-term personal loan.

If you already have some investments, let’s say, mutual funds, it is better to sell them off rather than taking out a loan. The benefits of liquidating your assets are you need not to pay any interest. But instead, you also get access to your earned profits, in terms of dividends.

That being said, there is also a catch to this option. It is only advisable to liquidate your assets if they have reached maturity. In some cases, your bank or your financial manager won’t let you sell funds.

Mortgage Against Your Property

Another alternative to liquidating your assets is seeking a mortgage against them. While most commonly, a mortgage is offered against an immovable asset, such as a piece of land or a house, but you can also access a mortgage against other high-value assets.

For example, you can seek a mortgage against your mutual fund’s policies, or you can also place your insurance policy as collateral.

The benefit of seeking a mortgage against your assets is only that you still own your assets. They are only being placed as collateral and will only be redeemed if you fail to repay your debt.

Organizing A Garage Sale

Quite possibly you’d have a lot of stuff at your home or your office that you don’t use anymore. There could be endless reasons for it including you may not need them anymore.

It is a good idea to sell them off to make some money when you know you don’t need them anymore.

Organize a garage sale for the stuff that you don’t use or need. Not only will it bring you the necessary funds but also help you get rid of all the clutter from your place.

Take Up A Side-Hustle

One of the best ways to make some quick money is by taking up a side-hustle. In fact, according to a survey, nearly 63% of Canadians have a part-time job apart from their regular stream of income.

Taking up a part-time job will solve your financial problems once and for all. Many part-time jobs are available either on a contract or hourly basis. It means you can expect to receive the payment for the work you do as soon as you complete and submit it.

It is noteworthy that you have endless options to choose from when it comes to taking a part-time job. You can take up freelance graphic design projects, or content writing orders. Or you can also take up a waiter’s job at a nearby diner. All you need is to know that you have the necessary skills needed to perform the task you take up.

Loan Against PF or 401(k) Account

Most of the time, financial advisors opine that withdrawing from PF or 401(k) accounts will harm a person’s credit score. And, as a matter of fact, this is true to some extent.

Despite the fact, there could be situations where you may find no other solution to your financial crunch.

But, still, it is rather best to seek a loan from your 401(k) account. The benefit is, your PF is still secure and all the interest that you pay adds up to your savings only. However, there’s a catch to this as well. When you take out a loan from your PF account, it is rather important that you pay it off in time. Otherwise, it may reflect as a distribution of payments and you may have to pay a penalty on the amount you borrow.

Facing a cash crunch is no ordeal. It could happen to anyone. What’s rather important is steering out of this financially troubling situation the most efficient way. You need to find a solution that not only fulfills your needs but also protects your financial future.

How to7 years ago

How to7 years ago

More4 years ago

More4 years ago

More6 years ago

More6 years ago

Interview4 years ago

Interview4 years ago

Other Internet Tech6 years ago

Other Internet Tech6 years ago

More6 years ago

More6 years ago

Business Ideas6 years ago

Business Ideas6 years ago