Interview

In this Interview, Abhishek Datta shares some valuable Insights on Financial Planning and Wealth Management

Published

4 years agoon

Abhishek Datta is a Dubai based financial planner and wealth manager. Over the years, he has helped his clients achieve their Financial Goals including those of several High Net-Worth Individuals(HNIs). In this interview with Times of Startups, Abhishek talks about the importance of financial planning and what all things can be done in order to achieve one’s goal of financial freedom.

Abhishek, Thank you for talking with us. How has been your journey so far as an independent financial planner and wealth manager?

Thank you for having me. After a 6-year journey with 2 of the biggest banks in the region, I decided to go independent and today I can proudly say that it was the right move for me on a personal and professional level. I have also achieved the desired results for my clients.

I have been able to help several affluent families and individuals grow their wealth and secure their finances.

The fact that several people are on the path to financial independence and success gives me immense satisfaction.

What are some of the market-specific challenges that you experienced as a financial advisor?

This could open a pandora’s box, but I will try to be brief.

Firstly, advisors in the region suffer from what is known as product syndrome. Clients are always on the lookout for a little higher yield or a slightly lower cost.

While those are extremely important, but lower transaction costs do not necessarily result in better returns in the long run. This trend is a result of the subconscious adaptation of the behavior of the different advisors they come across in their lives, who were pushing products, and the only differentiator they offer is transaction cost, or yield.

Financial products are commodities, and if you focus only on the transactional aspect, all you get is a transaction.

If you take a commodity, and use it to create a solution, only then can you get the desired results.

Another quirk in this market is the amount of traveling people do. Prior to the coronavirus crisis, the entire cycle could get extended by months because people are constantly traveling for work or holidays. The time between the first interaction and a follow-up meeting could be so long, that both the advisor and the client had to start from scratch.

This leads to conversations either dying off or results that are not ideal for the client due to the loss of interest/attention of the advisor and client.

But that is what makes my work challenging, to make the best use of that small window of opportunity.

Financial freedom has different meanings for different people. Based on your experience of working with a wide range of clients, which definition do you get to listen more often than not?. What are your views on Financial Freedom?

Financial Freedom affords people the luxury of choice, the ability to make decisions based on merit and not on cost.

For example, you would rather choose the school your kids attend, rather than the one that is most affordable. It could also mean the ability to pursue your passion at a certain time of your life, rather than continue working for money.

I consider a person as having achieved financial freedom, once they are able to focus on what is most important, i.e. life itself.

To achieve this, I, as an advisor, need to ask the right questions to people. Because a question, when asked right, leads to 80% of the answer.

Some financial planners make a mistake designing a lopsided portfolio wherein a large chunk of the investment is allocated to very few sectors. Some, on the other hand, make the mistake of adopting the ‘one size fits all approach’ wherein they design a generic portfolio without understanding the needs of the clients. What would be your suggestion for those who are entry-level managers and also for those who are managing their portfolio themselves?

All the above issues that you have mentioned, have a root cause.

Inadequate risk profiling.

We, as advisors, need to understand the client’s appetite for risk better in order to provide him with appropriate products based on this. We also need to understand the risk associated with a product.

“Most of us try to meet a client’s expectation, rather than manage them.”

A good advisor would carefully design a portfolio after considering the client’s risk profile and manage his expectation of returns.

The above would lead to a well-diversified portfolio and automatically manage the risk associated with it.

There are numerous other factors that one needs to look at, but it is impossible to elaborate on those in this brief conversation.

Given the market situation that we have due to the ongoing Covid-19 Pandemic, global stocks have taken a hit. However, it is also the perfect time to buy undervalued stocks. What is your take on the current situation?

I think there is definitely value in the market when it comes to specific stocks.

However, it is also important to understand, that this is not a financial crisis. Hence, we cannot yet predict when this will end, and what the new world will look like.

The access to free credit can lead to mispricing of stocks and assets. Most of the global economy has come to a standstill, manufacturing plants are idle, global trade is trending lower. A lot of companies have withdrawn their full-year guidance and some economies are predicting a 10-15% fall in their GDP.

Considering these factors, I urge caution, but also to deploy money in stages throughout this cycle and not go all in.

I would urge everyone to consult a qualified advisor and temper their return expectations for the future. Before you consider investing, prepare for the rainy day and hold cash in hand for at least 6-9 months of expenses.

How important is portfolio diversification?

Over the years, I have come to realize that 90% of my job is risk management.

Portfolio diversification is an extremely important tool for this purpose.

But this is also a highly misused and misunderstood concept.

Most clients I meet, have 10 different funds in their portfolio. Hence, they believe they have a diversified portfolio. 90% of the time, this is not the case.

For instance, A client owns an ESG fund that is extremely popular, with 40% tech stocks in it. He also has an income fund with 33% exposure to tech stocks. To top it all off, he owns a pure tech fund. So how diversified is he actually?

5 tech companies make up 18% of the S&P 500, all tech stocks. So how diversified is the 500 stock index actually?

Maybe it is time most people need to relook at their portfolios.

A crisis is always a good time to clean house.

Lastly, keeping the ongoing tough times in mind, what suggestion would you give to our readers so that they can attain their long term financial goals?

Start Early, spend less, pick your advisor carefully, do your due diligence and most importantly, do not be greedy.

When you hear stories of how people make phenomenal amounts of money in the stock markets and other investments, always remember that those people are not telling you how many times they lose money. Human beings like to amplify their successes to drown out their failures.

Remember, that this is the crisis, when you could lose money even if you bought US oil at close to 0.

Carolin Petterson is a Business Lady/Content Marketer and contributor for number of high-class business and marketing websites.

You may like

-

VidCruiter Acquires Ingage Solutions, an AI Interview Intelligence Technology founded at Stanford University

-

In this Interview, Timi Orosz talks about spirituality, mindfulness, and how spirituality can avert major global conflicts

-

An Interview with Tamas, London based Economist and founder of Alpha FX Acacdemy

-

An Interview with Adam Ferrari, Founder & CEO of Ferrari Energy

-

This Menswear Startup gets Accurate Customer Measurement via Smartphones and Webcams. Here’s What its Founder has to Say!

-

An Interview with Veteran Actor & Dancer Deborah Lee Fong

Interview

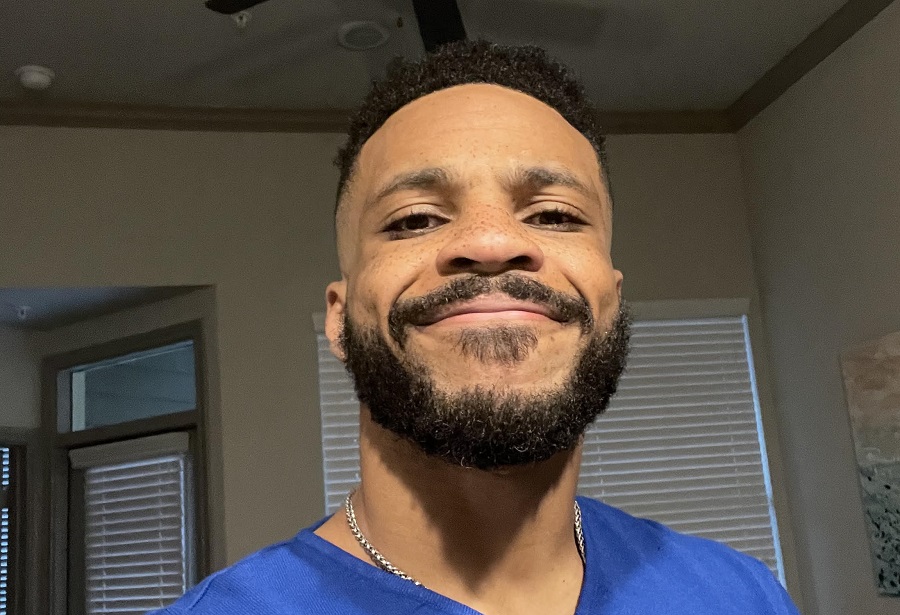

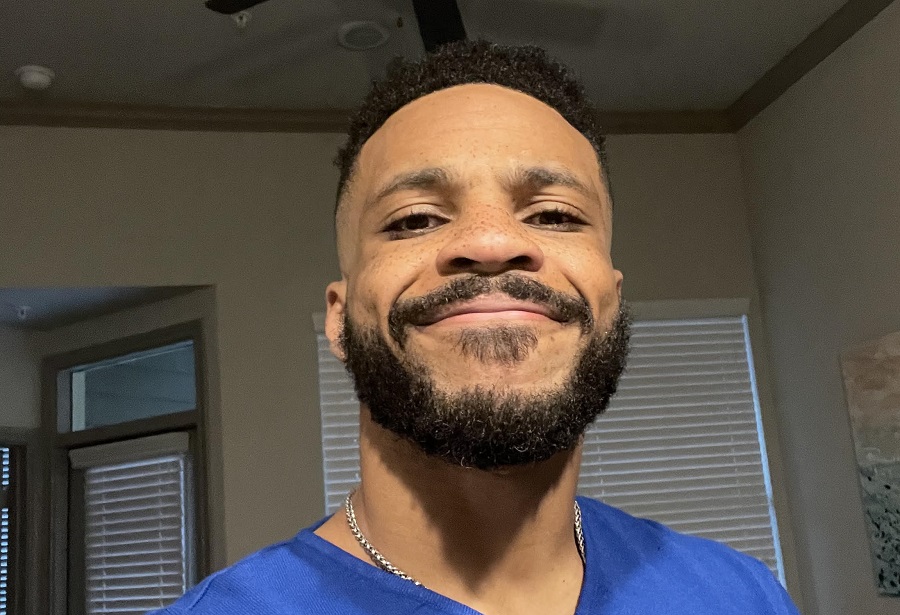

An Interview with Jonathan Printers Jr., Founder of ‘A Writers Business’

Published

10 months agoon

June 18, 2023By

Diana Smith

Jonathan Printers Jr. is the founder of ‘A Writers Business‘. He started this platform to help the writers’ community evolve into better writers and gain exposure. And ultimately, helping them achieve their financial goals as well. We recently interviewed Jonathon to more about his venture.

Jonathon, Thank you for doing this. Tell us something about yourself. What did you do before founding ‘A Writers Business’?

Thank you for having me. I’m primarily a mental health therapist and for the most part I spent years balancing that career with one in the national guard. I’d been interested in starting a business and really had no idea where to begin. Technology helped with that. Back in 2017, I first played around with the idea. I found it easy to create a website, get an address link, and add some information and images. From there, I created or collaborated on various online projects/businesses. The inspiration for A Writers Business originally came from an interest in poetry that soon expanded to include writers, authors, and content creators as well. There is an emphasis to help these individuals expand their audience.

What was your motivation behind founding ‘A Writers Business’? What were the initial challenges that you faced in your endeavor?

I did a few clothing lines in 2018 and 2019. I found it difficult to get those going because of the upfront costs of production. I needed something relatable, something I was interested in, and at a minimum upfront investment that could run without thousands of dollars invested. The poet and writer community is extremely large, and growing, and because of social media now many people have the opportunity to showcase their talents. A Writers Business began sharing various poets and writers. Now with a goal to help those in this community grow their brand.

Do you think the space for authors and poets will change forever with the adoption of tools like ChatGPT?

Absolutely. ChatGPT comes with pros and cons, right? I see ChatGPT helping authors and poets develop summaries, outlines, bullet points, or even short stories with ChatGPT. With some editing, authors will be able to use AI to generate many more words in a shorter time span. I haven’t seen prompts for poetry yet, but I’m sure it’s possible. The downside is that it will take the creativity, uniqueness, and style away from the poet. So, If I had a preference, I can see it being useful if I’m on a tight deadline. Other than that, I’d prefer someone’s honest words.

Taking forward the previous question, do you feel that Artificial Intelligence tools can ever replace authors and poets?

No, absolutely not. I see AI as a great tool for compiling information and providing great suggestions. Filler material. However, great authors and poets put their essence and personal perspectives in their writing. That’s something that can only come from the human heart and mind.

How does ‘A Writers Business’ help authors and poets in achieving their goals?

Our goal is to help authors and poets gain exposure, grow their audience, and have some support with promotions. We offer a variety of services including social media promotion, editing, poet and author interviews (free of cost), as well as support through marketing. Each service is tailored specifically to the individual client, their needs, and the feedback we receive.

How did Covid impact your business?

Tremendously. We were up and running in 2019-2020, focusing heavily on poetry contests, interviews, and promotion. With the pandemic, there was worry over finances and unemployment. As a result, I lost some support I had with maintaining the website, social media pages, and marketing authors and poets. Also, most of my time went into maintaining my household and career. Since then, we’ve slowly built back up refocusing our efforts on consistency, article writing, poet and author interviews.

How has ‘A Writers Business’ evolved over the years? In the coming months, how do you wish to transform the landscape of the writers community?

A Writers Business went from an Instagram platform exclusively promoting poetry to a network that includes several social media platforms, a medium publication, a complete website, and a community on Patreon. There are so many talented creatives that are deserving of acknowledgment. In the coming months to a year, I hope to meet with several poets and authors, give a few interviews myself, and shift our focus back to marketing.

What would you like the writing community and your audience to know?

I always invite feedback. I want to meet people and guide them toward their goals. So, if there’s a need in the community, please, let me know. And if you’re looking to boost your portfolio, come write for us!

Interview

An Interview with Joanne Docherty, Mental Health Expert and Founder of Starra Education

Published

1 year agoon

April 14, 2023

Joanne Docherty is the founder of Starra Education. Through Starra Education, she offers a range of accredited Mental Health Training and Qualifications crafted both for individuals and organisations. Joanne also teaches Psychology at The University of Glasgow. We recently interviewed her to know more about mental health challenges and how her company is addressing those challenges.

Can you tell us a little bit about your background and experience in mental health first aid training?

I have been actively involved in mental health first aid training for several years now, and I am passionate about helping individuals and organisations to better understand and address mental health issues. I have a strong educational foundation and have worked hard to gain valuable experience in this field. As an educator at the University of Glasgow, I have had the opportunity to teach students about mental health. I am also a member of the Scottish Parliament Cross Party Group on Mental Health, which has allowed me to contribute to policy discussions and advocate for better mental health services in Scotland.

In addition, I am the founder of Starra Education, a company that provides evidence-based mental health training programs to organisations. Through my work with Starra Education, I have been able to help many employees learn how to identify signs of mental health issues in their colleagues and take appropriate steps to provide support. I have also worked with organisations to provide mental health support and resources to those in need.

What inspired you to become involved in mental health first aid training and founding Starra Education?

I have always been passionate about mental health and wellbeing, and I have dedicated my career to working with various non-profit organisations and educational institutions to help individuals facing challenges. However, the impact of COVID-19 and seeing how people were being affected mentally was a significant reason I started to offer this qualification at Starra Education. I was supporting a lot of leaders through their leadership qualifications who were facing issues with their staff teams and didn’t know how best to support them, and I could see a massive gap. This motivated me to take action and offer mental health first aid training to help people identify and manage mental health issues in themselves and others.

I saw an opportunity to use my expertise to provide evidence-based programs that could teach leaders how to recognize the signs of mental health issues amongst their employees and take the necessary steps to support them effectively. My personal experiences with my mother, who was schizophrenic, have been a significant source of inspiration for my work. Witnessing the impact of mental health issues firsthand, I was driven to make a positive difference in the lives of others through education and support. Overall, the combination of these factors has fueled my passion for mental health first aid training and inspired me to offer this at Starra Education.

How do you think mental health first aid training can help individuals and communities?

Mental health first aid training is a vital resource for individuals and communities. It can help to reduce the stigma and discrimination associated with mental health challenges by increasing understanding and awareness. It can help individuals recognise the signs and symptoms of mental health issues and provide them with the skills and knowledge to support someone in need. It can also help break down the stigma surrounding mental health and create a culture of openness and support. By providing mental health first aid training to community groups, organisations, and workplaces, we can create a safer and more compassionate environment for everyone.

How do you tailor your training to different audiences, such as youth or older adults?

As an experienced educator, I understand that effective teaching is all about tailoring to the needs of the learners. Therefore, when training different audiences such as youth or older adults, I employ different strategies to cater to their learning needs. For instance, when working with younger learners, I use more interactive and engaging teaching methods that allow them to learn while having fun. For adults, I take a more practical approach by providing real-life scenarios that they can relate to and learn from. I also ensure that I understand the audience’s background, level of understanding, and learning style to create an effective learning environment. Additionally, I provide open communication channels to ensure that learners feel comfortable approaching me for extra support if they require it. Overall, I strive to create an inclusive and supportive learning environment that caters to the diverse needs of all learners.

How do you approach issues of stigma and discrimination in mental health first aid training?

A huge part of my approach to mental health first aid training involves addressing stigma and discrimination head-on. I believe that language is a powerful tool, and we need to be mindful of the words we use when discussing mental health. Many people use hurtful language without realising the impact it can have on those who are already struggling. Therefore, I encourage individuals to use appropriate language to reduce stigma and discrimination towards people experiencing mental health problems.

In addition to language, we also need to address the root causes of stigma and discrimination. I emphasise that mental health problems are prevalent, and anyone can be affected at any time, and individuals need to approach it from a place of compassion and empathy.

What are some of the most important skills or knowledge areas individuals should gain from mental health first aid training?

Individuals can gain essential skills and knowledge areas from mental health first aid training, such as: Understanding mental health and mental illness, this includes learning about common mental health conditions.

Recognising warning signs: this training can teach individuals how to identify signs and symptoms of mental health challenges, and how to distinguish between normal behaviour and signs of distress.

Effective communication:this includes learning how to communicate effectively and empathetically with someone who is experiencing a mental health challenge, and how to approach and support them.

Crisis management: it teaches individuals how to respond in a crisis situation. By gaining these skills and knowledge areas, individuals can become better equipped to support someone who may be experiencing a mental health challenge and provide them with the necessary help and resources they need.

You also teach Psychology at Glasgow University. How do you incorporate your subject matter expertise in Psychology in the training program you offer?

As a Psychology tutor at Glasgow University, I am able to incorporate my expertise in mental health and human behaviour into my mental health first aid training. I draw on the latest research in Psychology to provide participants with evidence-based strategies for supporting individuals with mental health issues. I also emphasise the importance of mental health education and provide participants with a deeper understanding of the causes and consequences of mental health problems. By incorporating my subject matter expertise into my training, I hope to provide participants with a comprehensive understanding of mental health and the tools to support those in need.

Finally, what advice would you offer to someone who is interested in becoming a mental health first aider?

Contact me and we can have a chat of course! In all seriousness, If you are interested in becoming a mental health first aider my advice would be to start by seeking out reputable training programs and organisations that offer accredited mental health first aid qualifications. Attend training courses, gain practical experience through volunteering or just being there for friends and family when they need support. It is also important to stay up-to-date on the latest research and developments in the field, and to engage in ongoing professional development. Most importantly, approach the work with empathy, compassion, and a commitment to reducing mental health stigma and promoting mental health and wellbeing.

Interview

An Interview with Fitness Entrepreneur Eugene Pallisco

Published

1 year agoon

December 28, 2022

As a fitness entrepreneur, Eugene Pallisco has dedicated his life to equipping people with the knowledge, willpower, confidence, and appropriate technique they need to reach their fitness objectives.

He has devoted a lot of effort to sculpting and refining his training philosophy, which is centered on the improvement of others, ever since working with motivating fitness mentors in high school. Pallisco began his career teaching group fitness classes, then broadened his knowledge by working one-on-one with gym patrons as a personal trainer before starting his private training company in the fitness sector.

Eugene is dedicated to assisting individuals in discovering the joy and freedom in their physical activity, whether through weightlifting, long-distance or high-intensity cardio, or sports training. He is confident that everyone can change their body into a strong, healthy one with the appropriate attitude, patience, and effort.

Entrepreneurship is an evergreen “buzzword.” Why do you think that is?

In my experience, being an entrepreneur can offer several benefits and perks that keep it an enticing proposition, including:

Control and flexibility: As an entrepreneur, you have the freedom to set your own schedule and work on projects that you are passionate about, allowing for a better work-life balance and the ability to pursue other interests.

Opportunity to make a difference: Starting a business can allow you to create something that positively impacts the world and helps solve a problem or meet a need.

Potential for financial success: If your business is successful, you may have the opportunity to earn a higher income than you would in a traditional job.

Independence: Being your own boss can give you a sense of freedom and autonomy that may not be possible in a traditional job.

Being an entrepreneur can be a gratifying and rewarding experience, but it also demands tremendous hard work and attention. I can’t emphasize this last part enough.

Why did you pursue the fitness industry?

Becoming a personal trainer can be a rewarding career choice for people who are passionate about health and fitness and enjoy helping others achieve their fitness goals. Some potential benefits of becoming a personal trainer include:

Personal fulfillment: Helping others improve their health and fitness can be a fulfilling and meaningful career. The reward of helping others, in particular, was my primary motivator in pursuing a career in the fitness industry.

Good pay: Personal trainers can earn a good salary, particularly if they have a solid client base and can charge competitive rates for their services. That said, you should always prioritize the client’s well-being over monetary gains.

Career growth: Personal trainers can advance their careers by earning additional certifications, specializing in certain areas of fitness, or starting their own training businesses, as I’ve done.

It’s important to note that becoming a personal trainer requires a significant commitment of time and energy. In addition to obtaining the necessary certifications, personal trainers must be able to motivate and support their clients and adapt to their clients’ changing needs and goals.

As a fitness professional, I’m sure you don’t back down from a challenge, but I imagine the COVID-19 pandemic took its toll on your industry. How did you overcome this?

The COVID-19 pandemic has significantly impacted the fitness industry. Many gyms and fitness studios were forced to close their doors or substantially limit their capacity to comply with public health measures designed to slow the spread of the virus.

In response, many fitness facilities and trainers, including myself, pivoted to offering virtual classes and training sessions, allowing them to continue serving their clients and generating revenue while in-person classes were impossible. Some facilities also implemented additional health and safety measures, such as frequent cleaning and sanitization, temperature checks, and mandatory masks, to make it safer for clients to return when restrictions were lifted.

In addition, outdoor and socially distanced fitness options, such as outdoor group classes and personal training sessions, became more popular as people sought ways to stay active while minimizing the risk of exposure to the virus. Thankfully, the year-round weather in Dallas is quite pleasant and enabled me to implement this approach.

To continue servicing customers and offering value throughout the epidemic, other fitness professionals and I had to be innovative and adaptive. As vaccination rates rise and public health regulations relax, the sector is expected to change and adapt to suit evolving requirements and concerns.

What are the advantages of working with a personal trainer?

Depending on the client and their goals, the perks will differ, but in most cases, I’ve found that there are several ubiquitous advantages to working with a personal trainer:

Customized workouts: A personal trainer can design a workout plan specifically for your needs and goals, considering your current fitness level, medical history, and any injuries or limitations you may have.

Motivation: Personal trainers can provide encouragement and support to help you stay motivated and committed to your fitness goals.

Expertise: Personal trainers are trained professionals with a wealth of knowledge about exercise, nutrition, and overall health and wellness. They can provide guidance and recommendations to help you achieve your goals safely and effectively.

Safe and effective workouts: Personal trainers can ensure that you are performing exercises correctly and safely, which can help reduce the risk of injury and help you get the most out of your workouts.

Accountability: Having a personal trainer can help you stay accountable for your fitness goals. You are more likely to stick to your workouts and make healthy choices when you have someone to regularly answer to and check in with.

Variety: Personal trainers can help you mix up your workouts and try new activities to keep things exciting and challenging.

Overall, working with a personal trainer can effectively improve your fitness level, help you achieve your goals, and lead a healthier lifestyle. It may not be for everyone, but it’s certainly worth exploring!

A Guide to Help You Find the Best AP Computer Science Tutor

Climate-smart Deeptech Company Ecozen Raises $30 M

BlackSoil’s Investment Grows 40% in FY24; Deploys $118Mn & Clocks 36 New Deals

Saad Kassis Mohamed led WeCare Raises $350000 for Lab-Grown Diamonds

UK-based fintech Nuke From Orbit raises £500k pre-seed funding to deliver smarter smartphone security

Japanese Fintech Leader Smartpay, partners with Chubb Insurance to accelerate digitization of the Japanese Insurance Industry, Anticipated to Surge to 80 Trillion Yen (USD $500 Billion) by 2027

Trending

-

How to7 years ago

How to7 years agoHow to register a Startup in USA

-

Interview5 years ago

An Interview with Joel Arun Sursas, Head of Clinical Affairs at Biorithm, Singapore

-

More4 years ago

More4 years ago6 Promising Up and Coming Fashion Companies

-

More6 years ago

More6 years agoFactors to Consider When Planning Your Office Design and Layout

-

Interview4 years ago

Interview4 years agoAn Interview with Russell Jack, Southland-based Yogapreneur and Mindfulness Teacher

-

Other Internet Tech6 years ago

Other Internet Tech6 years agoHow to become an IPTV reseller? A beginner’s guide

-

More6 years ago

More6 years agoIPTV business for beginners

-

Business Ideas6 years ago

Business Ideas6 years ago50 Small Business ideas with low investment