Many businesses are currently concerned with the slower rate of economic growth, traditionally slow levels of growth come with recession rumours and sometimes a starker reality.

Despite lower levels of growth in some industries, across the UK the tech industry is outpacing other sectors when it comes to growth. In fact, it’s expanding over two and a half times faster than the rest of the UK’s economy, with newly registered tech companies appearing at an average rate of 22%. By inspecting this highly competitive industry, it’s clear to see that certain regions seem to be attracting higher levels of tech professionals and providing optimal environments for tech firms to thrive.

So just what is it that contributes to a flourishing tech company? Microsoft Partners, Pragmatiq have carried out a data study to better understand the contributing factors that ensure tech firms thrive.

The League of Tech-Savvy Regions

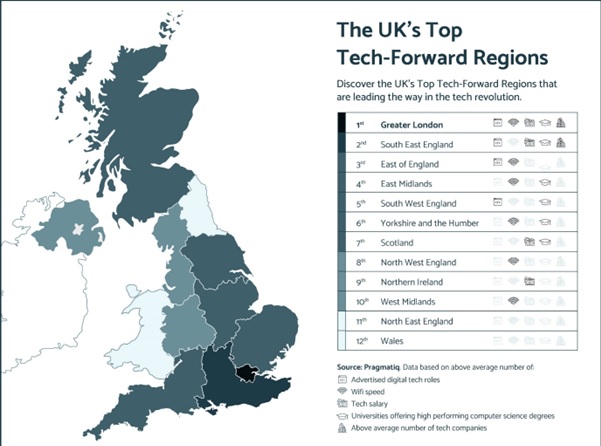

Using data collected and measured against varying criteria, each region has been ranked via a points system to distinguish innovation hub locations from regions with less focus on tech. To generate this data set the following criteria has been considered; the number of tech jobs advertised in an area, the average Wi-Fi speed, the average tech salary, the number of universities offering computer science degrees and of course the number of tech companies based in the region. Full details of the methodology used can be found at the end of this article.

The Winners

- Greater London

- South East England

- East of England

- East Midlands

- South West England

- Yorkshire and the Humber

- Scotland

- North West England

- Northern Ireland

- West Midlands

- North East England

- Wales

Greater London: An Obvious Winner

As the capital city of the UK with a reputation for being one of the world’s leading financial powerhouse cities, it’s no surprise that Greater London ranked at the top of the leaderboard. Scoring points across every single leaderboard category, above average for; salaries, tech jobs, wifi speed, high-performing universities and tech companies.

Unsurprisingly London is a popular location with many FTSE100 companies and disruptive start-ups alike. With capital’s workforce made up of almost 2.2 million millennials and Gen Zers who are considered digital natives, these combined factors are likely to drive up results.

When it comes to tech roles, London does offer the best salaries going when it comes to tech roles. The average tech salary sits at £55,000, around £17,500 more than a tech role based in South East England. Of course, this also considers London weighting, but it’s still over £16,000 more than the second-highest placing region for tech salaries (Northern Ireland).

The Second Most Tech-Savvy Region

South East England came out as another top scorer, achieving four out of a possible five points and putting two points between themselves and the third-place spot. As an area that offers exceptional job prospects within the tech industry, above average salaries, excellent universities offering Computer Science degrees and also around 4,812 tech companies, the South East is a clear contender for the most tech-savvy region.

The region is also an admirable area for study, especially where undergraduates are concerned. The region houses six high-scoring universities that offer a Computer Science degree, one of which (University of Oxford) sits within the Russell Group. Russell Group universities are notorious for their social, economic and cultural impacts, something the city of Oxford has benefited from in recent years. As well as presenting a TCU rating of 99%, the university also encouraged 21 spinout tech firms alone in the year 2017.

The South East region lost a point on WiFi speed by just 0.4Mbps where 72Mbps came out as the average. Less emphasis on budget for improved telecommunications is likely where the region has fallen short. According to one study on non-domestic premises, only 26.81%of businesses had full fibre installed, meaning many missing out on faster connection speeds without it.

Otherwise, it’s deemed a technology hub with above-average access to digital roles, good salaries, and number of registered tech companies. South East England is also in close proximity to London, making it ideal for businesses to operate out of the area without the extortionate price tag for rent or expenditure on salaries.

As part of the study, many expected the North East to come a close second to Greater London, especially as it has links to Manchester. In recent years, there has been greater interest in operating from Manchester, with companies such as the BBC, Google and Microsoft setting up bases there. This clearly shows that, whilst the interest and development are there, it’s not quite reaching top tech status as a region.

The Runners Up (in Joint Third Place)

- East of England

- East Midlands

- South West England

- Yorkshire and the Humber

- Scotland

Five regions were positioned in joint third place with 2 points each. With the exception of Scotland, they all ranked below average for tech salaries where the overall average pay appears at £37,342. Areas, like Greater London, were naturally going to outrank other regions here where the London weighting is considered. It’s worth noting that Glasgow is one of the most popular locations for millennials and Gen Z to live, which positively reflects in the average salary, along with the number of Universities offering quality Computer Science degrees.

Despite the promising figures around educational opportunities and a young force workforce, there are fewer job prospects the further north you head, which attributes to their lower score.

The South West region also finished in joint third place, despite average tech salaries placing at around £35,500, this is still a significant £1,842 shy of the UK average. In 2022, there was a 57% reported increase in the number of students studying tech and engineering courses within the region, which could attribute to a demand for talent.

One of the key elements that this data study has uncovered is that with the exception of Northern Ireland, it appears that the further away from Greater London you travel, sadly the lower the average salary becomes.

Regions Trailing Behind

- North West England

- Northern Ireland

- West Midlands

- North East England

- Wales

Landing in last place, Wales was let down by low average WiFi speeds and a lack of tech companies based in the area. The average WiFi speeds in Wales has a rate of 58.3Mbps with a humble 882 tech companies currently calling Wales home, compared to the staggering 23,901 London-based tech corporations. Despite scoring in last place, Wales does boast three universities that offer good Computer Science degrees, with Cardiff University ensuring a satisfaction rate of 78.8%. It seems many want to attend university in Wales and then pursue job prospects further afield.

In second to last place, the North East didn’t score any points and was let down by low average salaries for the tech sector. Offering around £32,500 for a tech-based role, £5,000 less than the average in the South East of England. Although let down by salaries, the North East is home to three high-scoring universities that offer sought-after Computer Science degrees. The region also boasts one of the highest proportions of STEM students in the country, making it an attractive hub for potential tech investment. With an influx of tech companies operating from the North East and North West, this is likely to drive up the region’s score in years to come.

A final word on tech regions

Regions, such as Greater London and South East England, are trailblazing when it comes to their tech forward approach and prospects within the industry. With a lot of businesses trickling down into South East England from Greater London, there has clearly been a much greater emphasis to ensure the region’s success. For example, in order to compete with Greater London, South East England has been able to ensure salary and access to digital tech roles are above average, making it an attractive place to work or set up a business.

This study highlights that every region has room to expand its emphasis on tech even further. With only one region (Greater London) scoring on all five criteria, and two regions (North East England and Wales) scoring none, there are clearly steps local councils and organisations can take to improve an area’s tech offering. Over time, it’s expected that places, such as the North East of England and Scotland will creep up the list further, scoring more points for advertised jobs and the number of tech companies.

Data Methodology

Five categories were defined in total. Through data collection, an average score was generated. Any region exceeding the average received one point with a total of five points to score. Below are the averages used to measure the data:

To determine the average score of Universities, a few additional steps were taken. Firstly, the most popular degree within the tech industry needed to be determined. By a significant margin, Computer Science came out on top.

After this point, a full list of universities offering a Computer Science degree was sourced from The Complete University Guide. They produced a score out of 100 for each university that measured things like overall student satisfaction and graduate prospects. Each university was then categorised into regions and an average TCU score was determined at 73.2%.

Any universities with a score above 73.2% were then separated and categorised into regions. Another average calculation was completed to reveal that any region with four or more universities scoring above 73.2% would gain a point. For example, Scotland has eight universities that score higher than average, therefore the region received one point.

How many regions scored above average?

- Number of advertised digital tech role – 4 out 12 regions

- Average WiFi speed – 6 out of 12 regions

- Average total salary – 4 out of 12 regions

- Universities offering a Computer Science degree with above average score – 6 out of 12 regions

- Number of tech companies – 2 out of 12 regions

How to7 years ago

How to7 years ago

More4 years ago

More4 years ago

More6 years ago

More6 years ago

Interview4 years ago

Interview4 years ago

Other Internet Tech6 years ago

Other Internet Tech6 years ago

More6 years ago

More6 years ago

Business Ideas6 years ago

Business Ideas6 years ago