- Nationwide survey shows young buyers favouring smaller purchases in gold and personal decision-making over investments in mutual funds and FDs

- Gold continues to dominate as the safest asset across generations

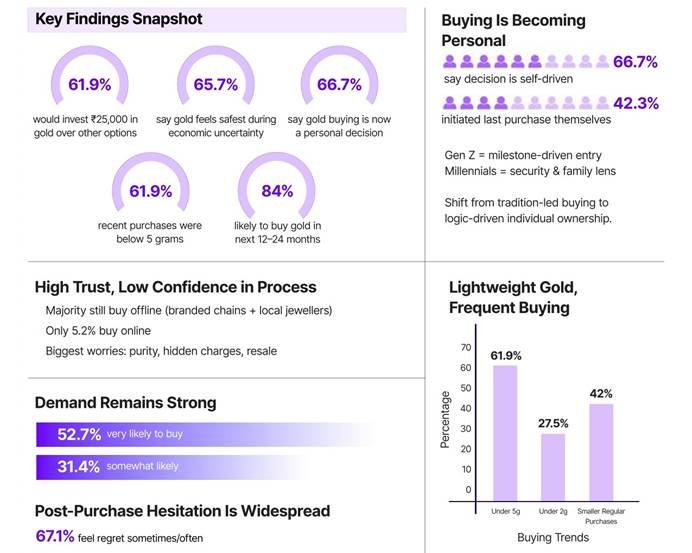

National, February 12 2026: Gold remains deeply trusted by young Indians, but the way it is bought is changing in quiet but meaningful ways. A nationwide survey done by Smytten PulseAI finds that gold buying is becoming increasingly self-led and lighter in ticket size. The survey, conducted with 5,000 consumers aged between 18-39, captures how tradition-led buying is steadily giving way to a more individual, logic-driven approach.

The survey reveals that 66.7% of the respondents’ purchases today are largely personal decisions, and 61.9% report that their most recent gold purchase was below 5 grams – indicating the changing nature of how the GenZ and Millennials look at gold – more as personal milestones and means of investments from their first paycheques.

Gold continues to be the first choice when safety matters

Despite growing access to modern financial products, gold remains the most trusted investment for young Indians.

According to the survey:

- 61.9% of respondents would choose gold if they had ₹25,000 to invest today, far ahead of mutual funds (16.6%), fixed deposits (13%), stocks (6.6%) and crypto (1.9%).

- During times of economic uncertainty, 65.7% said gold feels like the safest option compared to bank savings, mutual funds or equities.

These findings underline gold’s enduring role as the financial fallback across both Gen Z and Millennials.

Buying decisions are becoming more personal

While family influence continues to matter, gold buying is increasingly being driven by individual choice.

- 66.7% of respondents said gold buying today is largely a personal, self-driven decision rather than one influenced primarily by family.

- 42.3% said they themselves initiated the most recent gold purchase in their household, while 40% cited parents or elder family members.

This points to a clear generational split in how gold decisions are made. Gen Z is more confident deciding when and how to buy, treating gold as a self-led financial choice. Millennials, on the other hand, are more likely to view gold through the lens of household planning and long-term security, where purchases are still shaped by collective family priorities.

Smaller purchases are becoming the norm

The survey points to a clear move away from large, infrequent purchases toward lighter, more regular buying.

- 61.9% of recent purchases were below 5 grams, with 27.5% buying less than 2 grams and 34.4% buying between 2 to 5 grams.

- 42% of households now prefer smaller, more frequent purchases over time, compared to 58% who still make one-time, occasion-linked purchases.

For many first-time buyers, entry into gold is no longer limited to weddings.

- 24.3% said their first gold purchase was triggered by their first salary or personal income, while 23.9% cited an investment decision.

This reflects the generational split in entry behaviour: Gen Z is more likely to enter through personal milestones and smaller starter buys, while Millennials are more likely to anchor purchases to life events and longer-term security.

Trust still outweighs convenience in buying channels

Despite the rise of digital platforms, gold remains a trust-led category.

- 38.3% most often buy gold from large branded jewellery chains.

- 34.7% rely on local neighbourhood jewellers.

- Only 5.2% currently buy gold through online platforms or apps.

When asked about concerns:

- 49.4% cited purity and authenticity as their biggest worry.

- 21% pointed to hidden or making charges.

- 17% were concerned about resale value.

Regret after purchase is widespread

One of the most striking insights from the survey is the level of post-purchase hesitation.

- 67.1% of respondents said they have often or sometimes felt regret after buying gold.

The main reasons for regret included:

- Price paid (38.9%)

- Confusion around format, such as jewellery versus coins or digital gold (33.5%)

- Lack of information or understanding (18.8%)

This highlights a growing gap between trust in gold as an asset and confidence in the buying experience, affecting both Gen Z and Millennials.

Strong intent remains for the future

Despite these frictions, intent to buy remains high.

- 52.7% said they are very likely to buy gold in the next 12 to 24 months.

- Another 31.4% said they are somewhat likely to buy.

As Gen Z reshapes how gold is entered, and Millennials continue to rely on it for security, the survey shows a market that is evolving in behaviour, not weakening in demand.

About the Survey

This study was conducted by Smytten PulseAI in December 2025, surveying 5,000 consumers aged 18 to 39 across India to understand how Gen Z and Millennials are approaching gold purchases today. The survey captured real buying behaviour and intent, including when gold was last purchased, who drove the decision, what triggered the purchase, and how much was bought. It also mapped preferences on format and channels, alongside the biggest points of anxiety such as purity, hidden charges, and resale value. The study further assessed post-purchase hesitation and future intent, and compared gold with other investment options during times of uncertainty.

About Smytten PulseAI

Smytten PulseAI is India’s next-generation consumer-intelligence and market-research platform powered by artificial intelligence and machine learning. Our solutions help brands decode real-time shopper sentiment, unearth behavioural drivers, test concepts, track brand equity and drive growth-strategy decisions with speed and precision. With access to high-intent data from millions of consumers, and a suite of visual tools that turn insights into action, SmyttenPulseAI enables marketers to go beyond what consumers say to understand what they actually do. Headquartered in New Delhi, the platform serves innovative brands across FMCG, auto, tech, retail and beyond, helping them transform products, communications and campaigns by leveraging the power of behaviour-led, AI-enabled research. For more information, visit https://smyttenpulse.ai/